Parameta’s indices are built on vast and hard-to-source data from the TP ICAP brokerage network, providing rich insights you can’t find anywhere else.

The somewhat unprecedented policy-driven volatility that has characterised the start to 2025 has driven some interesting trends in customer appetites. Interest in out-of-the-money interest rate skews and pre-GFC historical data may be driven by an expectation that volatility will remain high for a sustained period and that the amplitude of market swings may challenge historical norms.

In April 2025, the S&P 500 experienced dramatic swings, initially plummeting by 12% due to new tariff announcements, only to rebound by 9.5% after a pause on reciprocal tariffs. Despite these fluctuations, the index managed to end the month up nearly 12% from its April 8th low.

According to USI Consulting Group, “Current policy measures will likely influence future economic activity, and market reactions to these developments may contribute to a period of heightened volatility, particularly in the near term.” (Market Volatility Update – April 2025)

In response to this heightened volatility, banks and hedge funds have shown increased interest in deeply out of the money swaption valuations. This trend is driven by several key factors: market volatility, economic uncertainty, volatility skew dynamics, and hedging strategies.

The interplay between tariffs, inflation, currency markets and interest rates has offered substantial opportunity, accompanied by an equal level of risk. With investors closely monitoring the Fed’s actions and economic indicators, recent discussions have focused on how interest rate and FX options can be used to inform risk management and investment strategies

Parameta, as part of TP ICAP, one of the largest inter-dealer brokers in the world, is a leader in producing indices that help investors track OTC markets. Parameta’s methodology includes analysing the skews and their indices cover a wide range of swap tenors and option expiries, offering extensive insights across different time horizons. This makes them a valuable tool for market participants looking to understand volatility dynamics in the interest rate swap market.

According to Christopher Rugaber, “…economists say, Trump’s ongoing attacks on Fed Chair Jerome Powell and his tariff policies could keep the longer-term interest rates that matter for consumers and businesses higher than they otherwise would be. A less-independent Fed can lead, over time, to higher borrowing costs, as investors worry that inflation may spike in the future. As a result they demand higher yields to own Treasury securities.

The significant daily movements in major indices have led to greater demand for options as investors seek to hedge their positions or speculate on future price movements.

Fluctuating interest rates, inflation concerns, and economic data releases have contributed to market uncertainty. Investors are increasingly using options to protect against or capitalize on potential large price swings.

Volatility skew refers to the difference in implied volatility between options with different strike prices. In volatile markets, the demand for out-of-the-money (OTM) options increases as investors look to hedge against extreme market moves. This results in a steeper volatility skew, where OTM options have higher implied volatility compared to at-the-money (ATM) options.

Banks and hedge funds may use deeply out of the money to hedge against significant market moves. Having a view into +/- 300bp-500bp enables our client to evaluate tail risk and cover a wider range of potential price movements, providing better protection in a volatile market.

As the financial landscape continues to evolve, understanding and leveraging these tools will be crucial for navigating the complexities of modern markets. The Parameta Volatility Index, particularly its Interest Rate Swap Volatility (IRSV) indices, offers clients a powerful tool for navigating interest rate uncertainty. By providing a model-free, forward-looking measure of implied volatility in EUR, GBP, and USD interest rate swap markets, the index enables more accurate risk assessment and pricing strategies. It distills complex market data—including both at-the-money and out-of-the-money swaptions—into a single, actionable volatility metric.

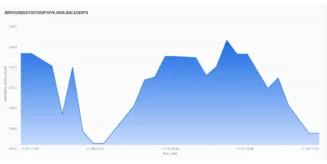

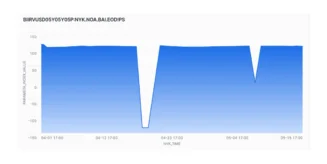

Using Parameta’s volatility index, we can examine the volatility during the election and the events from Liberation Day. In November 2024, the USD 5Yx5Y interest rate volatility index—an important gauge of market expectations for future interest rate fluctuations—showed modest movement despite the high-stakes U.S. presidential election.

The U.S. election, held on November 5, was expected to introduce uncertainty into financial markets. However, the volatility index remained relatively stable, fluctuating between 105.5 and 108.1 throughout the month. A slight uptick was observed in the days leading up to the election, peaking at around 107.75 on November 1. This likely reflected investor caution as markets braced for potential surprises.

Interestingly, volatility dipped slightly on election day itself and remained subdued in the immediate aftermath. This suggests that the outcome may have aligned with market expectations, or that the transition appeared orderly enough to avoid triggering significant risk repricing.

In April 2025, the USD 5Yx5Y interest rate volatility index saw a dramatic spike, surging above 112 on April 1 before sharply retreating the next day. This abrupt movement coincided with reports of new U.S. tariff measures, which likely introduced fresh uncertainty into the market. Investors reacted swiftly, pricing in the potential for inflationary pressures and a more aggressive monetary policy response from the Federal Reserve. The rapid normalisation that followed suggests that the initial fears may have been tempered by clarifying details or a reassessment of the broader economic impact. While volatility remained elevated through May—hovering near 108—no further extreme spikes were observed, indicating that the market had largely digested the tariff news and adjusted expectations accordingly. This episode underscores how sensitive rate markets remain to geopolitical and trade developments, particularly when they intersect with inflation and policy outlooks.

Related Solutions

Turn to Parameta for comprehensive indices and interest rate volatility data to help you navigate shifting markets with confidence.

Related Solutions

Turn to Parameta for comprehensive indices and interest rate volatility data to help you navigate shifting markets with confidence.

Interest Rate Volatility

Observable, indicative rates with 30+ years of historical data and comprehensive coverage across 300,000+ records and 30+ currencies.

Disclaimer

© 2025 ICAP Information Services Limited (“IISL”). This communication is provided by ICAP Information Services Limited or a member of its group (“Parameta”) and all information contained in or attached hereto (the “Information”) is for information purposes only and is confidential. Access to the Information by anyone other than the intended recipient is unauthorised without Parameta’s prior written approval. The Information may not be not used or disclosed for any purpose without Parameta’s prior written approval, including without limitation, storing, copying, distributing, licensing, selling or displaying the Information, using the Information in an application or to create derived data of any kind, co-mingling the Information with any other data or using the data for any unlawful purpose of for any purpose that would cause it to become a benchmark under any law, regulation or guidance. The Information is not, and should not be construed as, a live price, an offer, bid, recommendation or solicitation in relation to any financial instrument or investment or to participate in any particular trading strategy or constituting financial or investment advice or a financial promotion. The Information does not constitute a public offer under any applicable legislation or an offer to sell or a solicitation of an offer to buy any securities. The Information is not to be relied upon for any purpose whatsoever and is provided “as is” without warranty of any kind, either expressly or by implication, including without limitation as to completeness, timeliness, accuracy, continuity, merchantability or fitness for any particular purpose. All representations and warranties are expressly disclaimed, to the fullest extent possible under applicable law. In no circumstances will Parameta be liable for any indirect or direct loss, or consequential loss or damages including without limitation, loss of business or profits arising from the use of, any inability to use, or any inaccuracy in the Information. Parameta may suspend, withdraw or modify or change the terms of the provision of the Information at any time in its sole discretion, without notice. All rights, including without limitation intellectual property rights, in and to the Information are, and shall remain, the property of IISL or its licensors. Use of, access to or delivery of Parameta’s products and/or services requires a prior written licence from Parameta or its relevant affiliates. The terms of this disclaimer are governed by the laws of England and Wales.