Real-time indicative data is a type of financial market data that provides a snapshot of the current market conditions. It gives investors an immediate view of:

- Prices: The current bid and ask prices for a particular security.

- Volume: The number of shares or contracts traded within a specific timeframe.

- Open interest: The total number of outstanding contracts for a particular futures or options contract.

This data is typically updated continuously, providing investors with the most up-to-date information.

Uses of Real-Time Indicative Data:

- Trading decisions: Investors use this data to make informed buy or sell decisions.

- Risk management: Traders can monitor market fluctuations and adjust their positions accordingly.

- Market analysis: Analysts use this data to study market trends and patterns.

What is real time indicative data used for?

Real-time indicative data meets a variety of needs for traders, investors, and market analysts. Here are some key needs it addresses:

1. Timely Information:

- Immediate Price Discovery: Provides up-to-the-minute prices for securities, allowing traders to make quick decisions based on current market conditions.

- Real-Time Risk Management: Enables traders to monitor their positions and adjust them as needed to manage risk.

2. Informed Decision Making:

- Market Trend Analysis: Helps identify emerging trends and patterns in the market.

- Arbitrage Opportunities: Can be used to identify potential arbitrage opportunities where securities are mispriced.

- Technical Analysis: Provides the data necessary for technical analysis techniques, such as charting and indicator calculations.

3. Market Research:

- Market Sentiment: Can offer insights into market sentiment by analyzing trading volume and price movements.

- Market Depth: Provides information on the depth of the market, indicating the potential for price movement.

- Historical Data: Can be used to analyze historical market data and identify recurring patterns.

4. Operational Efficiency:

- Order Execution: Enables traders to execute orders quickly and efficiently based on real-time market information.

- Risk Management Tools: Supports the use of risk management tools and algorithms.

- Market Surveillance: Helps in monitoring markets for unusual activity and potential irregularities.

In summary, real-time indicative data is essential for anyone who needs to make informed decisions in the financial markets. It provides the timely, accurate, and comprehensive information necessary for trading, investing, and market analysis.

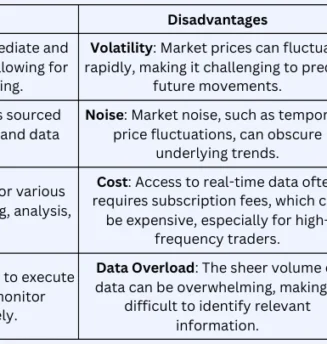

Advantages and Disadvantages of Real-Time Indicative Data

How does Real time indicative data support market transparency?

Real-time indicative data plays a crucial role in promoting market transparency by providing investors with access to accurate and up-to-date information. This transparency benefits the market in several ways:

- Price Discovery: By revealing current bid and ask prices, real-time data helps to ensure that prices are set fairly based on supply and demand.

- Informed Decision Making: Investors can make more informed decisions by having access to real-time information about market conditions, enabling them to assess risks and opportunities.

- Reduced Information Asymmetry: Real-time data helps to reduce information asymmetry, as all market participants have access to the same information at the same time.

- Fair Competition: Transparent markets foster fair competition among market participants, preventing insider trading and other unethical practices.

- Market Efficiency: Transparent markets tend to be more efficient, as prices reflect underlying value more accurately.

- Regulatory Oversight: Regulators can use real-time data to monitor markets for signs of manipulation or misconduct.

In essence, real-time indicative data serves as a cornerstone of market transparency, ensuring that markets operate fairly and efficiently.

How can you gauge market sentiment with Real time indicative data?

Gauging Market Sentiment with Real-Time Indicative Data

Real-time indicative data can provide valuable insights into market sentiment, which is the overall mood or attitude of market participants. Here are some key indicators to consider:

1. Volume:

- High Volume: Can indicate strong interest and potential momentum in a particular asset.

- Low Volume: May suggest a lack of interest or indecision.

2. Price Action:

- Breakouts: A sudden increase or decrease in price can signal a shift in sentiment.

- Gaps: Gaps in the price chart can indicate strong buying or selling pressure.

3. Depth of Market (DOM):

- Imbalanced Orders: A significant imbalance between buy and sell orders can suggest a strong bias.

4. Short Interest:

- High Short Interest: Can indicate a bearish sentiment, as investors are betting on a price decline.

- Low Short Interest: May suggest a bullish sentiment, as fewer investors are betting on a price decline.

5. Options Activity:

- Put/Call Ratio: A high put/call ratio (more puts purchased than calls) can suggest a bearish sentiment, while a low ratio suggests a bullish sentiment.

6. News and Events:

- Market Reactions: Analyze how the market reacts to news and events to gauge sentiment.

7. Technical Indicators:

- Moving Averages: The direction of moving averages can provide clues about market trends and sentiment.

- Relative Strength Index (RSI): An RSI above 70 suggests overbought conditions (potentially bearish), while below 30 suggests oversold conditions (potentially bullish).

Parameta Solutions offer indicative data across all assets we cover, which enhances market transparency and enables clients to gauge market sentiment and where value is heading. Risk managers, market makers and valuations teams can use such data to assess pricing levels and the value of over-the-counter instruments. Crucial in promoting efficient markets and fair trading conditions, this data helps capital markets participants to maximise their firm’s capital in a dynamic and competitive marketplace.

Disclaimer

© 2025 ICAP Information Services Limited (“IISL”). This communication is provided by ICAP Information Services Limited or a member of its group (“Parameta”) and all information contained in or attached hereto (the “Information”) is for information purposes only and is confidential. Access to the Information by anyone other than the intended recipient is unauthorised without Parameta’s prior written approval. The Information may not be not used or disclosed for any purpose without Parameta’s prior written approval, including without limitation, storing, copying, distributing, licensing, selling or displaying the Information, using the Information in an application or to create derived data of any kind, co-mingling the Information with any other data or using the data for any unlawful purpose of for any purpose that would cause it to become a benchmark under any law, regulation or guidance. The Information is not, and should not be construed as, a live price, an offer, bid, recommendation or solicitation in relation to any financial instrument or investment or to participate in any particular trading strategy or constituting financial or investment advice or a financial promotion. The Information does not constitute a public offer under any applicable legislation or an offer to sell or a solicitation of an offer to buy any securities. The Information is not to be relied upon for any purpose whatsoever and is provided “as is” without warranty of any kind, either expressly or by implication, including without limitation as to completeness, timeliness, accuracy, continuity, merchantability or fitness for any particular purpose. All representations and warranties are expressly disclaimed, to the fullest extent possible under applicable law. In no circumstances will Parameta be liable for any indirect or direct loss, or consequential loss or damages including without limitation, loss of business or profits arising from the use of, any inability to use, or any inaccuracy in the Information. Parameta may suspend, withdraw or modify or change the terms of the provision of the Information at any time in its sole discretion, without notice. All rights, including without limitation intellectual property rights, in and to the Information are, and shall remain, the property of IISL or its licensors. Use of, access to or delivery of Parameta’s products and/or services requires a prior written licence from Parameta or its relevant affiliates. The terms of this disclaimer are governed by the laws of England and Wales.