Understand your market and empower your decision making with access to our unparallelled capital markets coverage.

Key Features

Make decisions when they matter most with real-time insights and reliable data packages derived from real market activity.

Know what others can’t — leveraging the exclusive perspective and unique coverage of ICAP, PVM, and Tullett Prebon — across a vast array of financial instruments and markets.

Transform insight into action with exactly the coverage you need

Avoid confusion and noisy data with our meticulous and standardised approach for every market we serve.

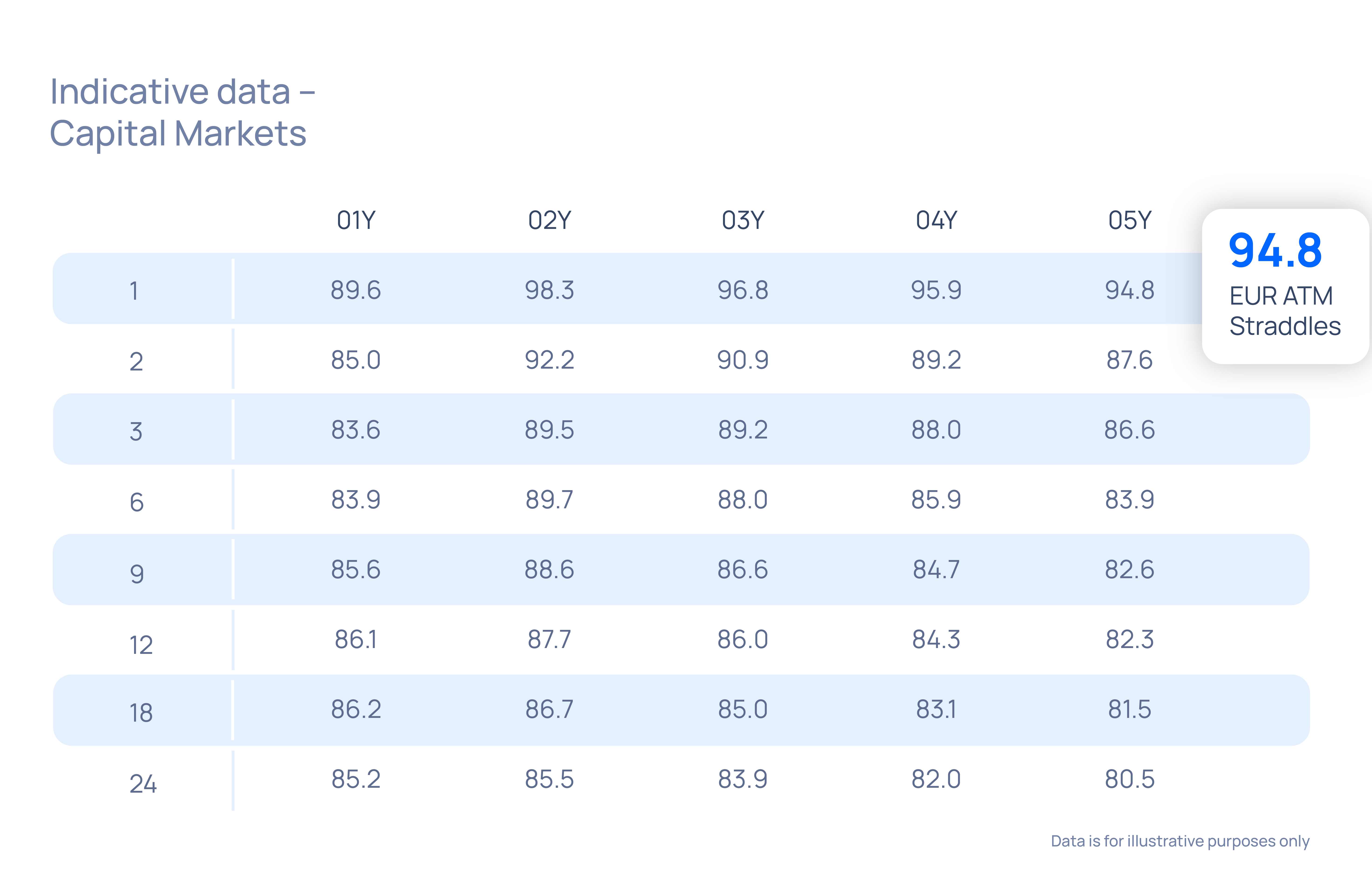

The EUR IRO Normal Vol over 3 years

Markets we cover

Inflationary Pressures Meant a Need for Historical Data to Inform Investor Decisions

Quantitative research teams were missing comprehensive inflation information and asked us to help.

Case Studies

View All Case StudiesContact us to access our data inventory

Latest Insights

The latest opinion from Parameta Solutions.

Contact Us

Have a question? Reach out to us