Interest Rate Derivatives Data

Overview

Access independent and impartial pricing across a full range of indicative interest rate swap data using the price flows generated by TP ICAP’s brokerage experts. This offering includes a range of linear swaps and other rate derivative products for managing interest rate risk and developing sophisticated hedging strategies. Our inter-dealer broker prices are available to support business applications at all stages of the investment process.

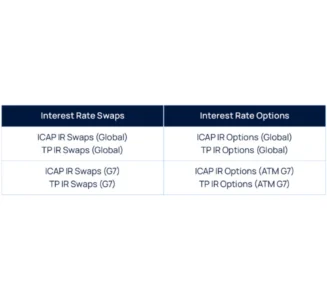

Discover our 8 updated interest rate packages

We are excited to share the launch of eight packages covering our indicative interest rate offerings, designed for greater clarity, a cleaner structure, and stronger alignment to users’ data requirements.

Key Benefits

Explore the benefits of our interest rate derivatives data.

Data Highlights

Data Highlights

records

currencies

years historical data

Coverage Details

Coverage Details

Record Count

37, 230 + (excl. Options)

Regions

AMER, APAC, EMEA

Sub-Asset Types

Overnight Index Swaps and Risk-Free Rates

Interest Rate Swaps

Forward Rate Agreements and Single Period Swaps

Short Swaps

IMM Swaps

Meeting Dates

FRA OIS Spreads

Basis Swaps

Cross Currency Basis Swaps

Cross Currency Swaps

Convexity Swaps

MUNI Swaps (TP SOFR)

Swap Spreads

Non-Deliverable Swaps

Currencies

40+ currencies

History Start Date

Variable, historical data as far back as January 1999

Brands

TP, ICAP

Field Count

Variable, 15+ fields depending on the instrument type

Direct Delivery Options

WebSocket, SFTP, Snowflake

Third Party/Channel Options

Active Financial/ Options (DRW), Bloomberg, BlackRock, FactSet, ICE, LSEG, QUICK, S&P (CapIQ), SIX Telekurs

Update Frequency

Real-Time, Intraday, End-of-Day

All figures are sourced from the Parameta Data Inventory as of 1 April 2025.