Parameta’s indices are built on vast and hard-to-source data from the TP ICAP brokerage network, providing rich insights you can’t find anywhere else.

With U.S. rate cuts seemingly on hold and a recent survey of U.S. inflation expectations reaching heights not seen since the 1980’s, we look at the track record of two common inflation hedging strategies, leveraging indices from Parameta Solutions.

Earlier in May, the FOMC held rates steady, but updated its policy statement highlighting the rising risk of a “stagflationary” environment1. Stagflation = Stagnation + Inflation, a term coined in the 1960’s U.K. for a combination of high inflation, stagnant economic-growth, and elevated unemployment.

Although the April U.S. CPI ticked up slightly, rising 0.2% month-over-month, it was slightly below the 0.3% increase expected, perhaps giving the Federal Reserve more time to wait and see regarding the potential impact of tariffs on consumer prices.

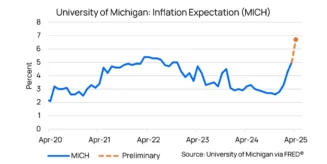

However, a recent survey from University of Michigan2 carried out between 25th March and 8th April found that “Year-ahead inflation expectations surged from 5.0% to 6.7%, the highest reading since 1981, and marking four consecutive months of unusually large increases of 0.5% or more.“

Consumer outlook may be somewhat softened by the subsequent partial reversal of tariffs, but there’s no doubt that trade policy continues to weigh heavily on consumers’ minds.

May has also seen Moody’s downgrade the U.S.’s long-term issuer and senior unsecured ratings to Aa1 from Aaa3. In their rationale for the downgrade, Moody’s cited sharply rising U.S. Federal debt, rising interest rates, and markedly increased interest payments, all due to continuous and widening fiscal deficits.

News that Trump’s “One Big Beautiful Bill” has been approved by the House of Representatives plays further into this narrative. The nonpartisan Congressional Budget Office estimates4 that this massive tax and spending bill will add $3.8T to the U.S.’s outstanding debt over the next decade.

With this backdrop of higher inflation expectations and worries about U.S. debt and deficits weighing on the bond markets, we look back on the 5-year track record of two common inflation hedging strategies, TIPs and Inflation Swaps.

For many investors, an allocation to TIPs (or Treasury Inflation Protection) securities has been the inflation hedge du jour. Although TIPs prices are sensitive to inflation expectations, they are primarily driven by interest rates, and in particular by inflation-adjusted interest rates – so called real rates. Put simply, as real rates rise, real prices fall, and vice versa.

An alternative strategy is to hedge against changes in expected inflation using inflation swaps. These instruments are sensitive to expected inflation without the swings and volatility caused by changes in real rates.

As shown in the graph above, real rates have trended up over the last five years. As expected, this has had a marked effect on TIPs prices. To examine this further we look at the relative performance of a market-weighted TIPs portfolio (we’ll use the TIPs U.S. ETF) compared with a fully-funded monthly rolling inflation swap strategy of similar duration.

We can clearly see from the graph above that, over this horizon, the TIPs portfolio has underperformed the inflation swap strategy due to rising real yields. Over the same period, the inflation swap strategy has provided more consistent returns with lower risk.

What lessons can investors draw from this:

- In a rising real rate environment, TIPs have clearly underperformed. But for an investor who is worried about future inflation but is also bullish about rate cuts, they may still fit the bill.

- Meanwhile, investors who are more optimistic about rate cuts, but still worried about inflation, may want to look at using inflation swap strategies such as the one above. These types of strategies can provide investors a degree of protection against changes in inflation expectations without taking on rates risk, thus allowing for a more targeted investment approach.

Parameta offers a range of indices tracking the performance of systematic inflation swap strategies. To learn more about Parameta’s indices and their uses, please contact [email protected].

Related Solutions

Turn to Parameta for comprehensive indices and inflation derivatives data to help you navigate complexity, manage risk, and seize new opportunities.

Related Solutions

Turn to Parameta for comprehensive indices and inflation derivatives data to help you navigate complexity, manage risk, and seize new opportunities.

Inflation Derivatives

Comprehensive inflation derivatives data from broking activities across European and US inflation markets.

Bibliography

Bibliography

1 https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20250507.pdf

Read This Article2 https://data.sca.isr.umich.edu/fetchdoc.php?docid=78452

Read This Article3 Ratings.Moodys.com/ratings-news/443154

Read This Article4 https://www.cbo.gov/publication/61422

Read This ArticleDisclaimer

© 2025 ICAP Information Services Limited (“IISL”). This communication is provided by ICAP Information Services Limited or a member of its group (“Parameta”) and all information contained in or attached hereto (the “Information”) is for information purposes only and is confidential. Access to the Information by anyone other than the intended recipient is unauthorised without Parameta’s prior written approval. The Information may not be not used or disclosed for any purpose without Parameta’s prior written approval, including without limitation, storing, copying, distributing, licensing, selling or displaying the Information, using the Information in an application or to create derived data of any kind, co-mingling the Information with any other data or using the data for any unlawful purpose of for any purpose that would cause it to become a benchmark under any law, regulation or guidance. The Information is not, and should not be construed as, a live price, an offer, bid, recommendation or solicitation in relation to any financial instrument or investment or to participate in any particular trading strategy or constituting financial or investment advice or a financial promotion. The Information does not constitute a public offer under any applicable legislation or an offer to sell or a solicitation of an offer to buy any securities. The Information is not to be relied upon for any purpose whatsoever and is provided “as is” without warranty of any kind, either expressly or by implication, including without limitation as to completeness, timeliness, accuracy, continuity, merchantability or fitness for any particular purpose. All representations and warranties are expressly disclaimed, to the fullest extent possible under applicable law. In no circumstances will Parameta be liable for any indirect or direct loss, or consequential loss or damages including without limitation, loss of business or profits arising from the use of, any inability to use, or any inaccuracy in the Information. Parameta may suspend, withdraw or modify or change the terms of the provision of the Information at any time in its sole discretion, without notice. All rights, including without limitation intellectual property rights, in and to the Information are, and shall remain, the property of IISL or its licensors. Use of, access to or delivery of Parameta’s products and/or services requires a prior written licence from Parameta or its relevant affiliates. The terms of this disclaimer are governed by the laws of England and Wales.