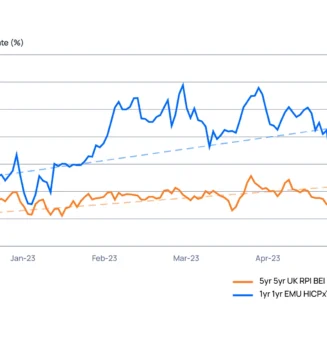

As widely predicted, the BoE hiked rates by 0.25% at the May ’23 Monetary Policy Committee (MPC) meeting and many economists are expecting another hike in June. The reality behind this is that UK Inflation remains stubbornly high and as the MPC minutes stated, “risks around the inflation forecast are skewed significantly to the upside” 1 . Inflation swaps data from Parameta Solutions shows that swap markets are still pricing in high levels of inflation for some years to come. The chart below shows the expectation of the annual inflation in one year’s time and the five-year average of inflation in the UK starting in five years’ time, implied from ICAP zero-coupon inflation swaps pricing. We should note that UK Inflation swap and bond markets use RPI rather CPI as a reference point, which makes it hard to compare the market’s expectation directly with the BoE’s CPI based 2% inflation target, nevertheless sentiment is clear.

Source: Parameta Solutions

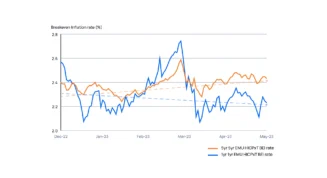

With the backdrop of UK inflation remaining sticky, we are expecting demand for inflation hedges to remain high. Investors wanting to hedge inflation e.g. Pension funds, are typically buyers of inflation-linked Gilts (or “linkers” as they are commonly called in the markets). Linkers can also be used by investors such as hedge funds, wanting to express views on inflation. We note however that a recent £4.5 billion issuance of a 2045 inflation-linked note put out by the UK DMO was oversubscribed by around ten times 2 . With demand outstripping supply at the recent auction, it’s a reasonable assumption that investors are increasingly looking to get exposure through inflation swap markets. Inflation swaps may be used as building blocks to create synthetic exposure to linkers or to match specific liability profiles. However, some investors are hesitant to go this route as the OTC derivatives markets are famously opaque. Things are, however, changing in this respect as Parameta Solutions, known for being a provider of high-quality OTC derivatives market data and risk solutions, is looking to provide investors with more transparency through index and benchmark solutions in the OTC derivatives markets, ICAP Information Services Limited is authorised as a benchmark administrator by the FCA in the UK and recognised by ESMA in the EU. Of course Inflation isn’t just a UK story. Euro area inflation may be stabilizing, but Euro Inflation swap data still provides a unique window on swaps market expectations. The chart below 3 shows that while expectations of annual inflation in a year’s time are falling, the expectation of average inflation remains relatively high in the five to ten year horizon.

Source: Parameta Solutions

Footnote: 1. Monetary Policy Summary and minutes of the Monetary Policy Committee meeting ending on 10 May 2023 (bankofengland.co.uk) 2. UK draws record 46.4 billion pounds of demand for new inflation-linked bond | Reuters 3. Forward breakeven rates implied from ICAP zero-coupon inflation swaps pricing

Bibliography

Bibliography

[1] Bank of England Monetary Policy Summary and minutes of the Monetary Policy Committee meeting ending on 10 May 2023

Read Source[2] Reuters UK draws record 46.4 billion pounds of demand for new inflation-linked bond

Read SourceDisclaimer

© 2025 ICAP Information Services Limited (“IISL”). This communication is provided by ICAP Information Services Limited or a member of its group (“Parameta”) and all information contained in or attached hereto (the “Information”) is for information purposes only and is confidential. Access to the Information by anyone other than the intended recipient is unauthorised without Parameta’s prior written approval. The Information may not be not used or disclosed for any purpose without Parameta’s prior written approval, including without limitation, storing, copying, distributing, licensing, selling or displaying the Information, using the Information in an application or to create derived data of any kind, co-mingling the Information with any other data or using the data for any unlawful purpose of for any purpose that would cause it to become a benchmark under any law, regulation or guidance. The Information is not, and should not be construed as, a live price, an offer, bid, recommendation or solicitation in relation to any financial instrument or investment or to participate in any particular trading strategy or constituting financial or investment advice or a financial promotion. The Information does not constitute a public offer under any applicable legislation or an offer to sell or a solicitation of an offer to buy any securities. The Information is not to be relied upon for any purpose whatsoever and is provided “as is” without warranty of any kind, either expressly or by implication, including without limitation as to completeness, timeliness, accuracy, continuity, merchantability or fitness for any particular purpose. All representations and warranties are expressly disclaimed, to the fullest extent possible under applicable law. In no circumstances will Parameta be liable for any indirect or direct loss, or consequential loss or damages including without limitation, loss of business or profits arising from the use of, any inability to use, or any inaccuracy in the Information. Parameta may suspend, withdraw or modify or change the terms of the provision of the Information at any time in its sole discretion, without notice. All rights, including without limitation intellectual property rights, in and to the Information are, and shall remain, the property of IISL or its licensors. Use of, access to or delivery of Parameta’s products and/or services requires a prior written licence from Parameta or its relevant affiliates. The terms of this disclaimer are governed by the laws of England and Wales.