As the transition from LIBOR to SOFR gains momentum, regulatory agencies, market infrastructure firms and market participants are collaboratively working towards a seamless migration. SOFR has gained traction as a preferred alternative to USD LIBOR due to its robust underlying transactions and alignment with the overnight Treasury Repurchase Agreement (REPO) market.

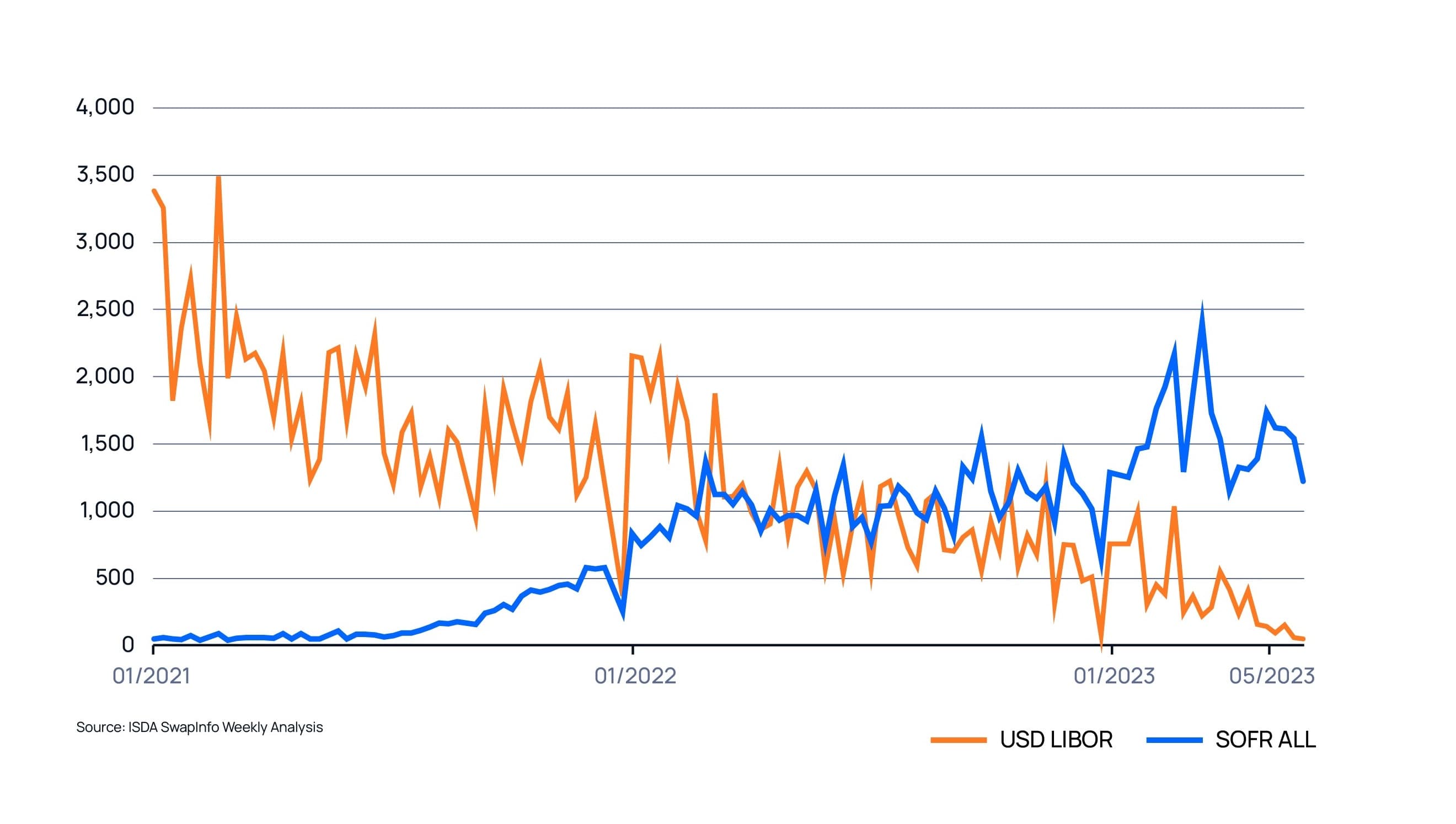

The transaction-based nature of SOFR is not only ensuring greater stability but also creating a surge in trading activity particularly in the OTC markets. Within the OTC markets, SOFR, OIS (Overnight Indexed Swap) trades rose in March 2023 as the banking crisis created volatility and SOFR was the most liquid source of interest rate hedges. The increased liquidity resulting from SOFR OTC trades, coupled with strong trading volumes in interest rate derivatives, futures contracts, and REPOs, is a testament to the success of this transition and the strengthening of capital markets. Volume statistics by Clarus1 show that by the end of 2022 there was a 350% YoY increase in SOFR USD Swaps ($60.5 trillion).

Data source: Clarus Financial May 10, 2023

Data source: Clarus Financial May 10, 2023

Benefits of SOFR to Instrument Trading

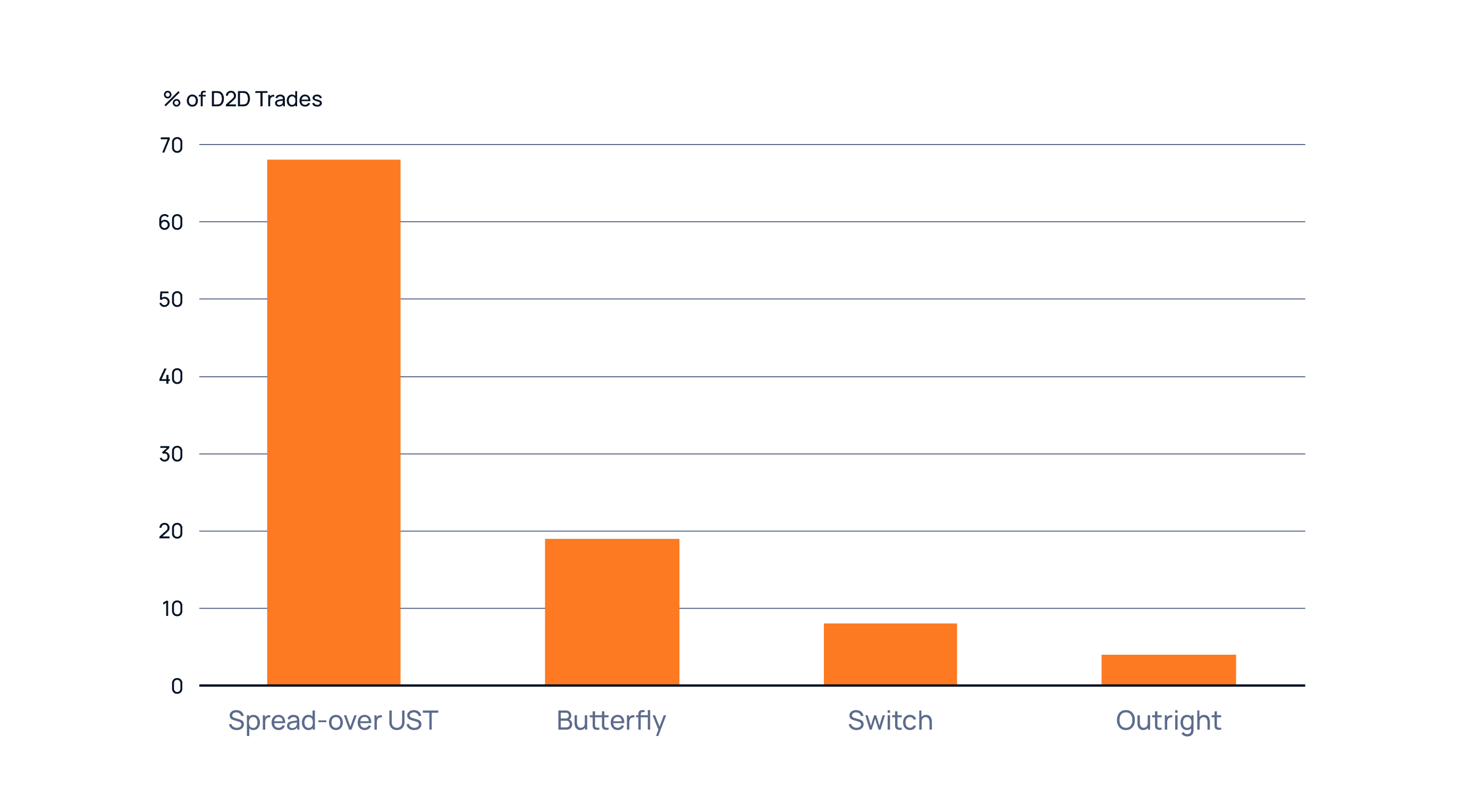

The surge in trading volumes signifies a broader acceptance and adoption of SOFR as a reliable alternative to LIBOR. SOFR OTC trades bring multiple advantages to market participants. They promote enhanced price discovery, tighter bid-ask spreads, and reduced transaction costs. Additionally, increased trading volumes provide investors with greater confidence in executing trades and managing their exposures effectively. Clarus' analysis of the SOFR market reveals that a significant portion of trading activity is concentrated in four primary instrument types: Outrights, Spread-overs, Switches, and Butterfly Instruments. These trades not only contribute to the overall liquidity of the SOFR market but also demonstrate market participants' growing confidence in the benchmark rate.

According to Clarus SOFR Swaps in the IDB (inter-dealer broker) market trade primarily as Spread-overs to US Treasuries. This is the most frequently traded instrument, with the highest notional volumes and dv01 terms and as such are the most important in setting prices of SOFR Swaps.

% D2D Trades

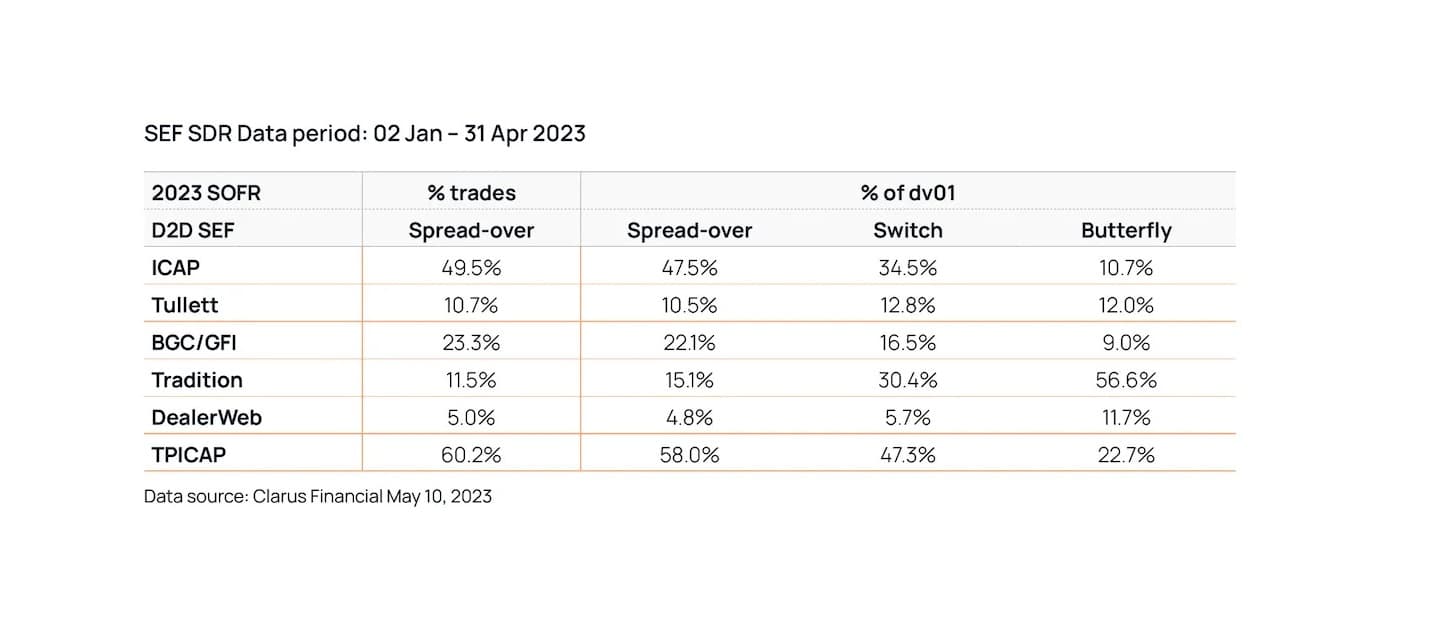

SEF SDR Data period: 02 Jan – 31 Apr 2023

Data source: Clarus Financial May 10, 2023

SEF SDR Data period: 02 Jan – 31 Apr 2023

Data source: Clarus Financial May 10, 2023

Glossary

DV01 The interest rate risk of bond or portfolio of bonds by estimating the price change in dollar terms in response to change in yield by a single basis point.

SOFR SWAP TRADE TYPE

SPREAD-OVER UST

Fixed rate risk transfer vs floating rate (SOFR), Bid/Ask levels quoted in bps spread to corresponding US Treasury benchmark issue. Prevalent in Dealer-to-dealer market.

This represents 68% of D2D trades.

BUTTERFLY

Fixed rate risk transfer vs floating rate (SOFR). Bid/Ask levels quoted in bps spread of 3 distinct tenors. The shortest and longest maturity legs are traded in equivalent directions; the risk of the intermediate maturity leg is equal and opposite to the sum of the other two legs.

This represents 19% of D2D trades.

SWITCH

Fixed rate risk transfer vs floating rate (SOFR). Bid/Ask levels quoted in bps spread of the simultaneous purchase and sale of two distinct tenors.

This represents 8% of D2D trades.

OUTRIGHT

Plain vanilla IR Swap trade – Fixed rate risk transfer vs floating rate (SOFR). Prevalent in Dealer-to-customer market.

This represents 4% of D2D trades.

Bibliography

[1] Clarus IDB Market Share in SOFR Swaps

© 2024 ICAP Information Services Limited (“IISL”). This communication is provided by ICAP Information Services Limited or a member of its group (“Parameta”) and all information contained in or attached hereto (the “Information”) is for information purposes only and is confidential. Access to the Information by anyone other than the intended recipient is unauthorised without Parameta’s prior written approval. The Information may not be not used or disclosed for any purpose without Parameta’s prior written approval, including without limitation, storing, copying, distributing, licensing, selling or displaying the Information, using the Information in an application or to create derived data of any kind, co-mingling the Information with any other data or using the data for any unlawful purpose of for any purpose that would cause it to become a benchmark under any law, regulation or guidance.

The Information is not, and should not be construed as, a live price, an offer, bid, recommendation or solicitation in relation to any financial instrument or investment or to participate in any particular trading strategy or constituting financial or investment advice or a financial promotion. The Information is not to be relied upon for any purpose whatsoever and is provided “as is” without warranty of any kind, either expressly or by implication, including without limitation as to completeness, timeliness, accuracy, continuity, merchantability or fitness for any particular purpose. All representations and warranties are expressly disclaimed, to the fullest extent possible under applicable law. In no circumstances will Parameta be liable for any indirect or direct loss, or consequential loss or damages including without limitation, loss of business or profits arising from the use of, any inability to use, or any inaccuracy in the Information. Parameta may suspend, withdraw or modify or change the terms of the provision of the Information at any time in its sole discretion, without notice.

All rights, including without limitation intellectual property rights, in and to the Information are, and shall remain, the property of IISL or its licensors. Use of, access to or delivery of Parameta’s products and/or services requires a prior written licence from Parameta or its relevant affiliates. The terms of this disclaimer are governed by the laws of England and Wales.